How Much Money Can I Put into My IRA or Employer-Sponsored Retirement Plan?

IRAs and employer-sponsored retirement plans are subject to annual contribution limits set by the federal government. The limits are periodically adjusted to compensate for inflation and increases in the cost of living.

IRAs

For the 2015 tax year, you can contribute up to $5,500 to all IRAs combined (the limit will be adjusted annually for inflation). If you have a traditional IRA as well as a Roth IRA, you can only contribute a total of the annual limit in one year, not the annual limit to each.

If you are age 50 or older, you can also make a $1,000 annual “catch-up” contribution.

Employer-Sponsored Retirement Plans

Employer-sponsored retirement plans such as 401(k)s and 403(b)s have a $18,000 contribution limit in 2015; individuals aged 50 and older can contribute an extra $6,000 each year as a catch-up contribution.

If you are currently contributing to an IRA or an employer-sponsored retirement plan, it may be wise to check the contribution limit each year in order to put aside as much as possible.

Distributions from traditional IRAs and most employer-sponsored retirement plans are taxed as ordinary income and may be subject to an additional 10% federal income tax penalty if taken prior to reaching age 59½. If you participate in both a traditional IRA and an employer-sponsored plan, your IRA contributions may or may not be tax deductible, depending on your adjusted gross income.

We hope this helps you come tax-day this April 15th, or in your tax-planning throughout 2015!

Thanks,

Mike

Michael M. Knittel

Director/Portfolio Manager

Lagunitas Asset Management

1024 Iron Point Road, Suite 100 Folsom, CA 95630 916.357.6656

"Helping Smart People Make Smart Investments"™

The information in this article is not intended to be tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. © 2015 Emerald Connect, LLC

|

Financial Planning, Estate Planning, Investment Management, Institutional Investments, Charitable Endowment Planning serving Folsom, El Dorado Hills, the Silicon Valley and all U.S. Investors. California Registered Investment Advisor Lagunitas Asset Management is here to help! Visit us at www.LagunitasMoneyIQ.com "Helping Smart People Make Smart Investments"TM Also serving El Dorado County, Sacramento, Granite Bay, Los Gatos and Beverly Hills.

Thursday, January 22, 2015

Tax-Planning Advantages of IRAs & 401(k)'s

Sunday, January 11, 2015

We Stand with France! We Stand with Charlie Hebdo!

“Far better it is to dare mighty things, to

win glorious triumphs, even though checkered by failure, than to take rank with

those poor spirits who neither enjoy much nor suffer much, because they live in

the gray twilight that knows neither victory nor defeat.”

It's impossible to put into words the range of emotion that I've felt in watching the people of France suffer so greatly at the hands of terrorists starting with the attack on the offices of Charlie Hebdo and culminating with watching the France Unity March this morning on the BBC. So many have been lost, so many have been shaken, yet so many STAND TOGETHER today in the face of such horrific and tragic events. The true beauty of humanity is shining ever-more bright this morning, from the arms of world leaders interlocked with the people whom they serve, the moments of silence observed around the world, and in the hearts of the millions of Parisians, Europeans, and other fellow marchers in the heart of Paris today.

Just like we witnessed here in the United States in the days, weeks, and months following the tragedy on 9/11, 13 years and 4 months to the day, there is so much good that can come in the aftermath of a national tragedy such as this. My hope is that the French people, just like we experienced here in the States, experience a profound period of unity and national pride. Our hearts, minds, and prayers are with the people of France today, tomorrow, and forever. May God Bless those families who lost loved ones in this past week's attacks in France. May God Bless the Marchers, the Leaders, and all People who are holding on to one another and building the great hope that so often rises in the face of extreme adversity.

Written below is an excerpt from a letter that I wrote and published on the anniversary of the 9/11 attacks about the good that sprung forth in the U.S. in the time that followed our own national tragedy. We are now united by a bond that does not recognize borders, and we too will "Never Forget" by standing with you and remembering the Charlie Hebdo tragedy as if it is our own. Captured so beautifully in the lyrics below, let's "Imagine" a future united by love, and rise from this time together.

“Imagine there's no countries

It isn't hard to do

Nothing to kill or die for

And no religion too

Imagine all the people

Living life in peace

You may say that I'm a dreamer

But I'm not the only one

I hope someday you'll join us

And the world will be as one”

Nothing to kill or die for

And no religion too

Imagine all the people

Living life in peace

You may say that I'm a dreamer

But I'm not the only one

I hope someday you'll join us

And the world will be as one”

Published 9/11/14 by Michael M. Knittel

Thirteen years ago, the lives of everyone in our country

shifted on a single moment, a startling terrorist attack that brought our

national consciousness to a level not seen since the end of the Cold War. On the day of the September 11th

attacks, my office went into full shut down and Wall Street fell silent for six

straight days in a time that greatly resembled the country’s reaction to the

assassination of JFK nearly forty years prior.

On the first day that the stock market reopened, the Dow Jones average

fell nearly 7.1% and by that Friday, the market was down over 14%

(www.investopedia.com). What did that

terrible event teach us and how are we different now?

For one, it changed an entire generation that had never been

through a collective national tragedy and popped the bubbles that life in our

country could never be touched. Second,

it raised the levels of national pride that were felt across the country, from

the baseball games that were played in New York City following the attacks, to

the flags that we all flew with pride outside our homes, car windows, and

office buildings. A lot of those

displays have faded into the background as time has passed, but I know that in

my heart and in the hearts of many people I know, we were forever bettered by

something so awful occurring.

When I

reflect on the aftermath of September 11th, 2001, I feel a

tremendous amount of pride in the way people pulled together, from the top of

our government to my neighbors who went to Ground Zero as first responders and

hope that we won’t ever forget the love, support and kindness that came out of

such an earth-shaking day. I know that I sure won't and remember each day, just how fortunate we are to be blessed by a life of peace and freedom.

Thank you so much for reading and God Bless France, the United States, and all those countries and people who hold Peace, Love and Unity so dear.

To donate to the victims and families of those affected by the Charlie Hebdo tragedies, please follow this link https://www.leetchi.com/c/solidaritecharlie.

To donate to the victims and families of those affected by the Charlie Hebdo tragedies, please follow this link https://www.leetchi.com/c/solidaritecharlie.

Thank You,

Mike

Michael M. Knittel

Director/Portfolio Manager

Lagunitas Asset Management

1024 Iron Point Road, Suite 100

Folsom, CA 95630

916.357.6656

Securities offered through Fortune Finacial Services (FFS), Member FINRA/SIPC. Advisory services offered through Lagunitas Asset Management. Lagunitas Asset Management and FFS are unaffiliated entities.

1024 Iron Point Road, Suite 100

Folsom, CA 95630

916.357.6656

"Helping Smart People Make Smart Investments"™

Securities offered through Fortune Finacial Services (FFS), Member FINRA/SIPC. Advisory services offered through Lagunitas Asset Management. Lagunitas Asset Management and FFS are unaffiliated entities.

Thursday, January 8, 2015

Top Tax Tips for 2015!

Last-Minute Legislation: 2014 Tax Extenders

After contentious congressional negotiations and the threat of a presidential veto, the Tax Increase Prevention Act of 2014 — extending 55 tax provisions through the end of 2014 — finally became law in December with less than two weeks left in the tax year. Unfortunately, the fate of these provisions for 2015 and beyond remains uncertain.

Temporary tax measures can serve useful purposes — allowing a period of evaluation, responding to natural disasters, providing economic stimulus, or meeting specific budgetary needs.1 However, Congress has often waited until the end of the year to address these provisions, as lawmakers procrastinate and wrangle over who should receive tax breaks and what the costs might be for the U.S. Treasury. The one-year retroactive extension in the legislation is projected to cost about $42 billion over 10 years, far less than an abandoned bill estimated at $400+ billion that included two-year and permanent tax extensions.2

Obviously, these end-of-year exercises make it difficult to plan. However, you still may benefit from some of the extended provisions on your 2014 taxes.

Help for Individual Taxpayers

The two largest tax breaks for individuals, each valued at about $3.1 billion, are (1) allowing homeowners whose mortgage debt was canceled or forgiven to exclude the forgiven debt from their gross income, and (2) allowing taxpayers to deduct state and local sales taxes in lieu of state and local income taxes.3 The latter is especially significant in states that do not have a state income tax.

The two largest tax breaks for individuals, each valued at about $3.1 billion, are (1) allowing homeowners whose mortgage debt was canceled or forgiven to exclude the forgiven debt from their gross income, and (2) allowing taxpayers to deduct state and local sales taxes in lieu of state and local income taxes.3 The latter is especially significant in states that do not have a state income tax.

Taxpayers can deduct mortgage insurance premiums along with residential mortgage interest, and they can make an above-the-line deduction (prior to calculating adjusted gross income) for qualified higher-education tuition and related expenses paid during

the year.

the year.

Educators can deduct up to $250 for unreimbursed classroom expenses — qualifying books, supplies, and supplementary materials — they spent during the 2014 tax year.

Investors 70½ and older can make tax-free qualified charitable distributions (QCDs) of up to $100,000 directly from their IRAs in lieu of all or part of their taxable required minimum distributions (RMDs) for 2014. However, because the deadline to make QCDs and RMDs was December 31, the late passage of the bill provided a narrow window of opportunity.

Business and Energy Incentives

The three largest tax cuts in the legislation are a research credit for businesses ($7.6 billion), extension of the construction start date to receive a 10-year credit for renewable power generation ($6.4 billion), and avoidance of taxation on certain “active financing” income by U.S. companies operating overseas ($5.1 billion).4

The three largest tax cuts in the legislation are a research credit for businesses ($7.6 billion), extension of the construction start date to receive a 10-year credit for renewable power generation ($6.4 billion), and avoidance of taxation on certain “active financing” income by U.S. companies operating overseas ($5.1 billion).4

Smaller businesses may benefit from three other extensions that are applicable to companies of all sizes: (1) the $500,000 Section 179 limit for expensing capital expenditures in the current year, (2) first-year bonus depreciation allowing companies to deduct half the cost of new capital purchases, and (3) the work opportunity tax credit for hiring candidates from veterans and other “targeted groups.” A provision focusing

specifically on small companies allows investors to exclude 100% of capital gain from the sale or exchange of qualified small-business stock.

specifically on small companies allows investors to exclude 100% of capital gain from the sale or exchange of qualified small-business stock.

These are just a few of many extensions for businesses and alternative-energy production that run the gamut from addressing broad issues to serving narrow special-interest groups. For example, the research credit, which has been extended 17 times since 1981, reflects a widely held concern that U.S. businesses are falling behind their international counterparts.5–6 Alternative-energy credits and tax breaks for large multinational companies are more divisive but have strong defenders and require comprehensive analysis.

The fact that these issues are combined with tax breaks for racehorse owners, NASCAR track owners, and Puerto Rican rum only muddies the waters. And all the business and energy tax extensions come too late to allow for strategic planning.

An Ineffective Policy

A report by the Congressional Research Service regarding the 2013 tax extensions offered a cogent summary of the problem in avoiding long-term decisions on temporary measures: “[The] rationale for enacting temporary tax provisions is undermined if expiring provisions are regularly extended without systematic review, as is the case in practice.”7

A report by the Congressional Research Service regarding the 2013 tax extensions offered a cogent summary of the problem in avoiding long-term decisions on temporary measures: “[The] rationale for enacting temporary tax provisions is undermined if expiring provisions are regularly extended without systematic review, as is the case in practice.”7

Most of the 2014 extensions have been extended multiple times amid continuing discussion of the need for broader tax reform. Some observers are hopeful that the decision to extend these provisions only through 2014, the minimum term, may force Congress into more definitive action in 2015, but others fear that the exercise will be repeated again next year.8

One congressman who “reluctantly” voted for the tax extender bill called it “a lousy way to run a tax code.”9 Most Americans would probably agree.

As with other tax issues, be sure to consult with your tax professional before taking any specific action.

1, 5, 7) Congressional Research Service, 2013

2, 9) Bloomberg News, December 4, 2014

3–4) Tax Foundation, 2014

6) Bloomberg Businessweek, December 1, 2014

8) TheHill.com, December 2, 2014

2, 9) Bloomberg News, December 4, 2014

3–4) Tax Foundation, 2014

6) Bloomberg Businessweek, December 1, 2014

8) TheHill.com, December 2, 2014

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright 2015 Emerald Connect, LLC.

"Top 10" Social Security Strategies!

File and Suspend: A Flexible Social Security Strategy

The Social Security system may seem complex, but understanding your claiming options could help increase your benefits. One strategy to consider is “file and suspend” (sometimes referred to as “voluntary suspension”).

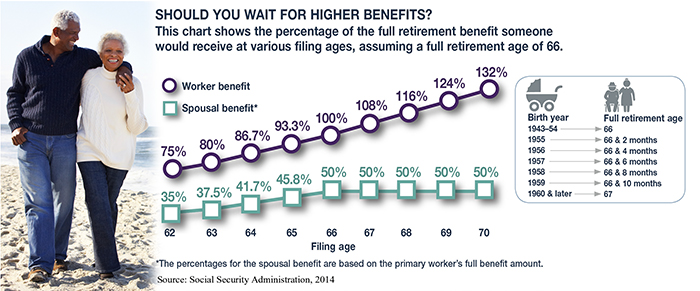

The basic concept is to file for benefits at full retirement age (66 to 67, depending on year of birth) and immediately suspend benefits before receiving any payments. This allows your spouse to be eligible for spousal benefits; meanwhile, you earn delayed retirement credits (up to age 70), which increases your future benefit. It also provides flexibility for retroactive benefits regardless of marital status.

Options for Married Couples

The following hypothetical examples are used for illustrative purposes only and assume a full retirement age of 66 for both spouses. Actual benefit amounts and results will vary.

The following hypothetical examples are used for illustrative purposes only and assume a full retirement age of 66 for both spouses. Actual benefit amounts and results will vary.

Jeff is eligible for a $2,000 monthly Social Security benefit at age 66 but wants to continue working until age 70. His wife, Meg, is eligible for a $700 benefit at age 66 based on her own earnings. If Jeff files and suspends his benefits upon reaching full retirement age, Meg would be eligible for a $1,000 spousal benefit at age 66 (50% of Jeff’s full retirement benefit). Jeff could continue accruing delayed retirement credits, increasing his benefit at an 8% annual rate, and at age 70 his monthly benefit could reach $2,640. (See chart for benefit percentages.)

If Meg is younger than Jeff, she could claim a spousal benefit as early as age 62 (assuming Jeff has filed and suspended his benefits). However, her spousal benefit would be permanently reduced. For example, at age 62 her spousal benefit would be only $700 (35% of Jeff’s full benefit).

Todd and Jill both want to continue working past full retirement age to earn their maximum benefits. If Todd files and suspends at age 66, Jill can file a restricted application for a spousal benefit at age 66, and both can continue working and earning delayed retirement credits, up to age 70.

Of course, the roles could be reversed in all these examples. However, the spouse who files and suspends cannot later apply for spousal benefits.

Retroactive Benefits

Under standard filing rules, an individual who files for Social Security after reaching full retirement age can request a lump-sum payment for up to six months of retroactive benefits. For example, if you file at age 66½, you could request a lump sum equal to the benefits you would have received had you filed at age 66; if you filed at 67, the payments would go back to 66½. Future benefits would be based on the lower monthly benefit that would have been set at the earlier date.

Under standard filing rules, an individual who files for Social Security after reaching full retirement age can request a lump-sum payment for up to six months of retroactive benefits. For example, if you file at age 66½, you could request a lump sum equal to the benefits you would have received had you filed at age 66; if you filed at 67, the payments would go back to 66½. Future benefits would be based on the lower monthly benefit that would have been set at the earlier date.

If you file and suspend benefits and later request to reinstate them, you could request a lump-sum payment equal to the benefits you would have received since the time you filed. For example, if you filed and suspended at age 66, you could receive two years of retro-active payments at age 68. This might be helpful for someone who faces a change in health or other situation that makes it more important to claim a lump sum than to receive higher monthly benefits going forward.

Medicare and HSAs

When considering the file and suspend strategy, you should be aware that the act of filing — even if immediately suspending benefits — triggers automatic enrollment in Medicare Part A. Because Part A hospital insurance is premium-free for most people, this may not be an issue. However, if you have a high-deductible health plan with a health savings account (HSA), you can no longer contribute to the HSA once you sign up for Medicare.

When considering the file and suspend strategy, you should be aware that the act of filing — even if immediately suspending benefits — triggers automatic enrollment in Medicare Part A. Because Part A hospital insurance is premium-free for most people, this may not be an issue. However, if you have a high-deductible health plan with a health savings account (HSA), you can no longer contribute to the HSA once you sign up for Medicare.

Social Security decisions can have a lasting impact on your financial situation, so you may want to seek professional guidance before taking action.

Source: Social Security Administration, 2014

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright 2015 Emerald Connect, LLC.

Subscribe to:

Posts (Atom)